© 2016 All Rights Reserved. Do not distribute or repurpose this work without written permission from the copyright holder(s).

Printed from https://www.damninteresting.com/foreign-exchanges/

Please provide a pipin' hot welcome for Michael, our newest human.

By the summer of 1944, the Mount Washington Hotel had been mothballed for two years. Nestled deep in the Appalachian mountains, the sprawling resort was once a favorite getaway for wealthy New Englanders. But in the wake of the Great Depression and the second war to end all wars, the end appeared nigh for this silent relic of America’s Gilded Age.

Then the US Treasury department offered its owners a staggering $300,000 if they would host a conference—to start in less than a month. An army of hotel workers and hastily recruited townspeople got to work. On the first of July, 730 delegates from 44 countries checked in and proceeded to conduct one of the most influential economic conferences of all time, carving into history the name of the sylvan outpost where it was held: Bretton Woods.

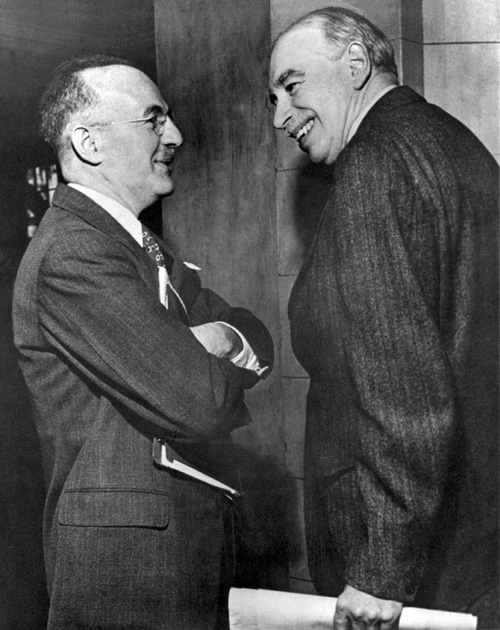

Known officially as the United Nations Monetary and Financial Conference, the Bretton Woods talks focused primarily on foreign exchange rates (the price of US dollars, say, in British pounds) and other tedious minutia of monetary policy. With the world engulfed in war, few in those days were giving much thought to topics as arcane as these. But some people were giving it quite a lot of thought. One was US Treasury advisor Harry Dexter White, who had been toiling in relative obscurity to forge an exchange rate policy that all nations on earth would agree to. Nothing like this had ever been attempted before.

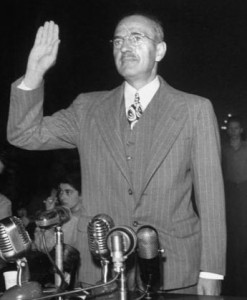

Now the technocrat from humble roots was about to pull it off, earning recognition and his first official government title: Assistant Secretary to the US Treasury. Harry White would soon experience recognition of another sort, with his name splashed across newspaper headlines—but for reasons having nothing to do with exchange rates, economics, or Bretton Woods.

One of the outcomes of World War 1 was, quite unfortunately, the setting of political and economic conditions that led to World War 2. There were many factors at play, but the isolationist policies of the United States—such as its refusal to join the League of Nations—certainly didn’t help. After the second world war the US would play a far more active political role on the world stage as a key member of the United Nations. Lesser known is how the US propelled itself into the economic center of the post-war world and indeed came to dominate global finance. The man chiefly responsible for this turnabout was a most unlikely fellow.

Harry Dexter White was born in 1892 to Lithuanian immigrants who ran a hardware store in Boston’s tenement district. He followed his father into the nuts and bolts business and quit his first attempt at college, returning to hardware until enlisting in the Army for an uneventful tour of duty in France during World War 1. At the age of thirty, White again strolled into the groves of academia, this time blossoming at Columbia University, then getting hooked on economics at Stanford, and finally earning his Ph.D. and a teaching position at Harvard.

Harry’s academic years were marked by decidedly liberal thinking. In the 1924 presidential race, he pledged his support to the long-shot Progressive Party candidate Robert La Follette, who would run a distant third behind John Davis and victor Calvin Coolidge. His writing conveyed a passion for stabilizing economies, pointing to centralized control of trade as a potential model. Harry even went so far as to learn Russian so he might travel there to study it first hand.

But Harry would ultimately go to Washington instead. Frustrated with academia, he wanted to do more than just teach his big ideas. He wanted to put them into action. As such, he was only too happy to take advantage of an opportunity in 1934 to move to the nation’s capital to advise US Treasury Secretary Henry Morgenthau and, before long, President Franklin Delano Roosevelt.

It was a perfect match. Neither Morgenthau nor FDR had much interest in (nor patience for) the tedium of economics. They needed someone who would work in the shadows doing endless research on arcane topics then put them into plain English. They needed what would later be known as a “wonk.” And Harry was the perfect wonk.

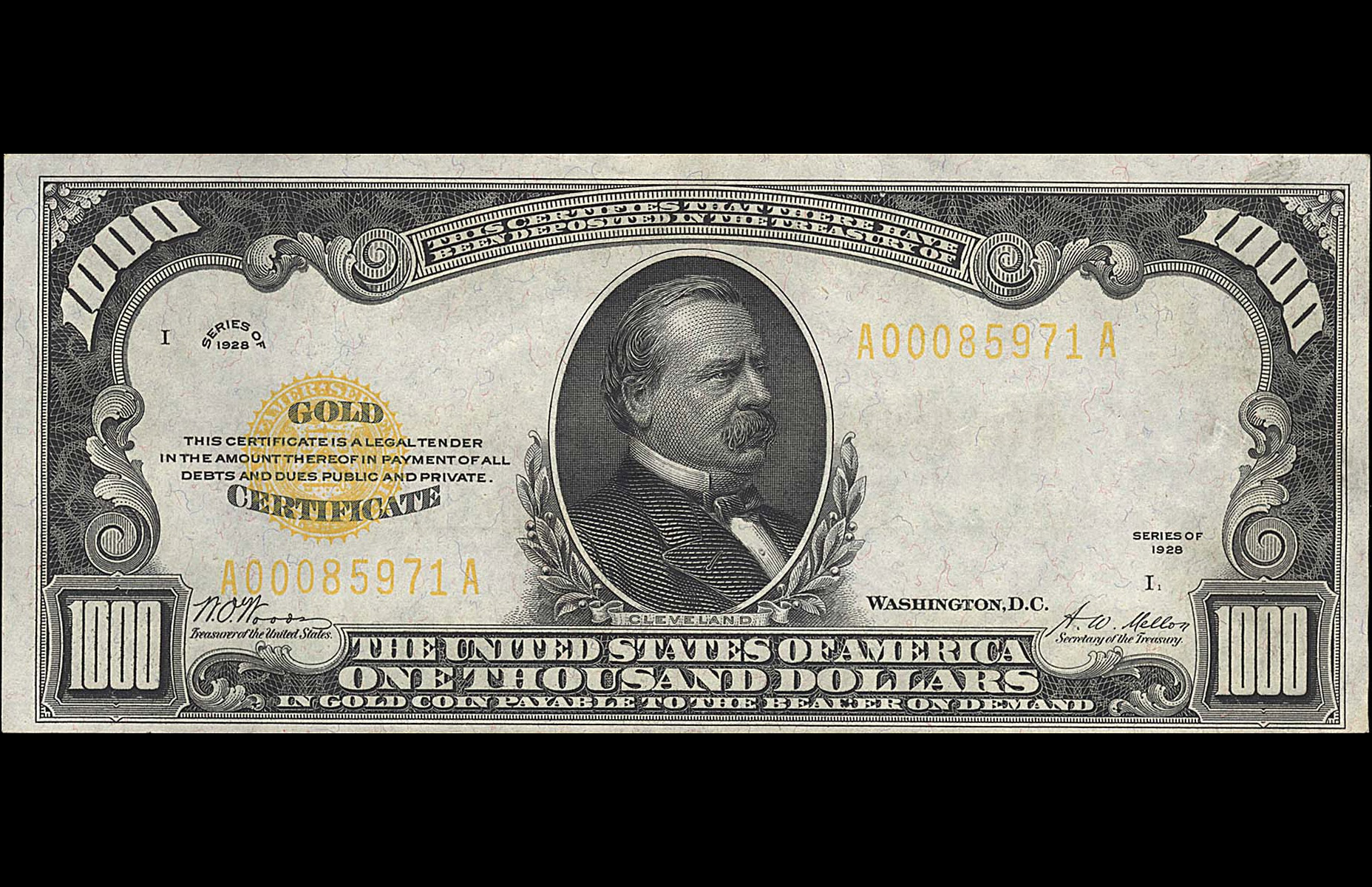

Much of Harry’s research centered on world trade problems brought on by the collapse of the gold standard in World War 1. This policy, whereby countries backed their currency with a fixed amount of gold, had been maintaining international price stability for quite a long time. It was conceived in 1717 by none other than Sir Isaac Newton, known famously (though apocryphally) for discovering gravity after a knock on the noggin from a falling apple. Newton gets little credit for his accomplishments, some quite impressive, as Master of the Royal Mint in London. But when one lays the groundwork for modern physics, these things happen.

With the gold standard, paper currency exists as a proxy for a country’s gold reserves. It can be tempting, however, for a country to print more money than it can back up with gold, say when it is at war. That’s what happened during World War 1. Countries needed urgently to buy armaments and pay their soldiers, and decided to unpeg their currency from gold and print as much money as they needed. As the world would soon learn, this can lead to all sorts of other problems, not the least of which is inflation. With more units of currency chasing the same quantity of stuff, the price of stuff goes up. Sometimes by quite a lot.

In the years between the two world wars, the price of currency fluctuated wildly—and not just so a country could pay its bills. A country might launch a currency war to competitively devalue its currency, simply to make its products artificially cheaper. Even the United States fiddled with the price of gold, buying and selling it to artificially manipulate domestic prices, for reasons bordering on whimsical. President Franklin Delano Roosevelt one morning raised the price of gold by twenty-one cents. “It’s a lucky number,” he said from his bed, “because it’s three times seven.”

In September 1939, Adolf Hitler ordered the invasion of Poland. Two days later, Great Britain and France declared war on Germany and the Second World War was underway. During the two years before officially joining the war, the United States provided massive support to Great Britain by way of the Lend Lease Program, in which the Americans essentially rented armaments to the British. It gave Great Britain a fighting chance, and put it into considerable debt, both financial and political, to the United States.

In December 1941, a mere two weeks after Pearl Harbor, US Treasury Secretary Morgenthau directed Harry White to draft a plan for economic stability following the end of the war. It was brashly forward-thinking and gave Harry Dexter White the opportunity of a lifetime. He got right to work.

What came to be known as the “White Plan” called for three things to be in place the moment the war ended: Massive capital to help war-torn countries rebuild, the resumption of international trade, and stable exchange rates. This last objective was vital. To achieve it, Harry White proposed renewal of the gold standard, fixing the value of all currency to the world’s most precious metal. Harry loved the gold standard.

Harry’s proposal was circulated among treasury officials around the world. But it was not the only one. The esteemed British economist and author John Maynard Keynes (pronounced “canes”) wrote a competing proposal. Unlike Harry, Keynes was well known and respected, even by the general public. Keynes also had an opinion of the gold standard. He hated it.

Born into British privilege, as a young boy Keynes suffered a weak constitution but showed preternatural intellect. On at least one occasion, he infused family prayers with math, using algebraic symbols to represent his mother and younger brother. “Let Mother equal x,” he intoned, “and let Geoffrey equal y”. By the age of 26 John Maynard Keynes had already earned a lifetime appointment at King’s College in Cambridge.

Like White, Keynes found his greatest calling in the field of economics. His genius and creative approach to solving the most challenging quantitative problems was compared to that of Albert Einstein. He titled what became perhaps his most influential book The General Theory of Employment, Interest and Money.

In the depths of the greatest war of all time, responsibility for post-war economic stability rested on the shoulders of these two men from starkly different backgrounds. The Keynes proposal centered on the idea of a new global currency. He called his proposed currency

The White proposal called for a gold standard based on gold, and gold-convertible currency, just like the old days. Or so it seemed. Keynes was concerned about the meaning of the term “gold-convertible currency.” Might any member currency be convertible? Or only one? Or perhaps bancor?

White dodged the question. He would not answer Keynes, and instead suggested any further clarification be deferred to a conference of representatives from all allied nations. Keynes had no choice but to go along, but did make clear that he would not support any policy whereby only the US dollar was to be convertible to gold. However that is precisely what Harry White had in mind.

In addition to forging an agreement on exchange rates, there was also the matter of how to enforce it. White wanted the US to run a new body, to be named the International Monetary Fund (IMF), to see that nations adhered to what would come to be known as the Bretton Woods system. He allowed that Great Britain could run the much less influential World Bank, then known as the International Bank for Reconstruction and Development, to lend money to developing countries and those recovering from the war. Keynes wanted it the other way around. Compared to the IMF, the World Bank position seemed like a consolation prize.

Although 730 delegates from 44 countries converged on Bretton Woods, most of them could just as well have stayed on the golf course. Many in fact did. The essential negotiations were between the United States and Great Britain. And both sides had good reason for confidence in getting their way.

Great Britain had the celebrity economist John Maynard Keynes as their chief negotiator. They could also simply walk away, should negotiations fail, and the idea of getting nations to agree to any international accord absent Great Britain was all but preposterous. They also had great national pride, stiff upper lips, and a quiet disregard for American intellect. Winston Churchill once summarized British respect for the United States by remarking that “we can always count on the Americans to do the right thing, after they have exhausted all the other possibilities.”

The United States had plenty of negotiating power of their own, even in the midst of a world war. For starters the US was then the largest creditor nation on earth and it held two-thirds of the world’s gold in its reserves (in stark contrast to today, where the US is among the top debtor nations). They also had a massive IOU from the British for the food, oil, and materiel the US furnished in the war effort. And in Harry White they had a chief negotiator willing to use procedural manipulation and outright deception in order to get his way.

The practical objective of the Bretton Woods conference was to get 44 signatures on a document, known as the Joint Statement, containing the terms of a new international agreement. Delegates were organized into committees to hash out nuances of a working draft of the agreement, a draft which so far left unanswered the question of which currency was to be convertible to gold. The draft in fact made no mention of a gold-convertible currency at all, indicating only that the value of member nation currency be “expressed in terms of gold.”

Then, just before the meeting of a committee Harry knew Keynes could not attend due to a cleverly-designed scheduling conflict, Harry added the words “gold-convertible currency” to the draft. Great Britain was represented on this committee by delegate Dennis Robertson, who in verbal discussion allowed that, for practical purposes, it was acceptable “to regard the United States dollar as what was intended when we speak of gold convertible exchange.” It was all Harry needed.

When it came time to prepare the final draft of the Joint Statement, the document for signature, Harry directed his staff to finally spell out his intention by replacing “gold” with “gold and U.S. dollars” throughout the 96-page document. Delegates saw this version of the Joint Statement only as they were asked to sign it, some literally as they were checking out of the hotel, with no opportunity to see the change. Keynes would not know what White had done until well after everyone had departed Bretton Woods.

Via questionable machinations, Harry Dexter White had prevailed. And now there was to be just one currency that meant anything to most of the world, the US dollar, convertible to gold at a rate of $35 per ounce. The agreement made at Bretton Woods elevated the US dollar from a national currency to a global one, moved the financial center of the world from London to Washington, and established two governing bodies that influence world economics to this day. But although the US did indeed get what it wanted at the Bretton Woods conference, its intentions would soon be thwarted by a most unexpected turn of events.

At the time of the Bretton Woods conference in 1944, relations between the United States and the Soviet Union were still comparatively good. They were among the allied forces, after all, that would soon defeat Adolf Hitler and bring an end to World War II. But with the breakdown of the Yalta accords in February 1945, those relations went decidedly sour. Thus began the Cold War, suspicions of espionage, and a rabid hunt for spies.

In November 1945, the Federal Bureau of Investigation sent a memo to the White House claiming that seven government officials were providing secret information to Soviet agents. One of those named was Treasury Department rock star and architect of the Bretton Woods conference: Harry Dexter White.

It’s unclear whether or not the memo made it to President Harry Truman, who had ascended to the office upon FDR’s death the year before. In any event, in January 1946, Truman nominated White to be the US executive director at the IMF. This was no surprise given White’s leadership at Bretton Woods. Indeed, Truman planned to later nominate White for the IMF’s top job, managing director, a nomination that would have sailed through but for the next communiqué from the FBI.

Alarmed by news of White’s nomination, FBI director J. Edgar Hoover then prepared a new and detailed memo focusing on the allegations against Harry White. According to Hoover, White was reportedly providing Treasury documents to known Soviet agents. The report claimed to be based on numerous sources but did not provide iron-clad proof of any wrongdoing. Unlike the first memo, this one certainly did make it to the president. Truman didn’t know what to believe. No big fan of Hoover, nor of the overzealous hunt for spies that put the careers of honest people at risk of ruin, he let the nomination stand.

The president did agree to quietly move White into a position with more limited access to government secrets—just in case—and he made a startling offer: Britain could appoint a head for the IMF after all, and the United States would do the same for the World Bank. The US did not give a reason. The American change of tune was an official diplomatic communiqué along the lines of, “Just kidding about the IMF thing!” The British did not question the turnaround and wasted no time in delivering an official diplomatic response along the lines of, “Sure!”

Harry Dexter White expressed outrage at the allegations of espionage. He had never even heard of the supposed informants ratting him out, he claimed, and was most certainly not a spy for the Soviets. The claims seemed particularly far-fetched considering his accomplishment at Bretton Woods, making the United States arguably the most powerful nation on earth. Would he have tried so hard if his true allegiance was to another country?

In August of 1948, White put on a rousing performance in front of the House Un-American Activities Committee (HUAC), the US Congressional investigative body which would come to be known for flimsy accusations and political grandstanding in its relentless pursuit of Communists. HUAC had not summoned Harry White. Such was his eagerness to clear his name, Harry White had in fact asked for permission to testify. His opening statement of complete denial of the accusations, and of his steady support for all things American, was answered by spirited applause from the audience. Committee members remained stone-faced.

White deflected charges with confidence, facts, and indeed tried to discredit HUAC itself, equating its hearings to unlawful “star chamber proceedings.” When a young Congressman on the committee named Richard Nixon prodded him to admit knowing his chief accusers, Whittaker Chambers and Elizabeth Bentley, he was steadfast. No, he repeated, he could not recollect knowing anyone by those names.

His bravado performance in front of HUAC did not come without a cost. On the train home to New York he suffered terrible chest pains. White’s doctor diagnosed a heart attack. He died the next day. Rumors naturally swirled among his detractors of some sort of take-out by the Soviets, or that his death had been faked, but such hearsay was never substantiated.

The witch hunt for Soviet spies among American government officials and cultural elite continued with inglorious gusto. The scourge known as McCarthyism, named for Senator Joe McCarthy, would ruin numerous careers before being written into American history as one of its darker chapters. But Harry Dexter White’s name would not be among them. He had stood up to the red-baiting and prevailed.

Revolutionary as it was, the Bretton Woods accord would not last all that long. It was not fully operational until 1958. And soon its fatal flaw started to show. While it did insulate global prices from unwise monetary and fiscal policies of member nations, the glaring exception was the United States. The global regime would work only so long as the US exercised impeccable economic discipline at home. This meant the US had to resist the urge to get out of economic binds by printing money.

In the 1960s, other countries began to suspect the US was indeed giving in to such temptation— that it was printing more money than it had gold to back up, owing in no small part to the extraordinary financial cost (not to mention human cost) of the war in Vietnam. This did not sit well with other countries. They were particularly bothered by the fact the United States, to produce more of its currency, need only fire up the printing presses. Any other nation had to actually produce goods.

Not only were these other nations perturbed, they also had to confront the very real risk that their US dollars would one day not be redeemable for gold. So in the 1960s, other countries, led by France, began redeeming US dollars for gold in rather large quantities.

In 1971, with US gold reserves at frighteningly low levels, President Richard Nixon took an axe to the central tenet of the Bretton Woods accord: the convertibility of US dollars to gold. This time, there was no conference in the woods and little or no meaningful consultation with other countries. There was only a unilateral action that came to be known as the Nixon Shock.

From that day forward, the price of most world currency has floated freely—and sometimes wildly—in response to market forces. A number of countries such as Hong Kong and Saudi Arabia kept (and still keep) their currency pegged to the US dollar, backed by nothing more than the full faith and credit of the United States. And some countries such as Panama and Zimbabwe simply use US dollars as their own legal tender.

Nixon’s action was not without consequence. Freed of the Bretton Woods shackles, the US could give up the pretense of having enough gold to back up its currency. The United States dollar was now a fiat currency, from the Latin term for “let it become,” created by decree. Uncle Sam could print all the dollars he wanted, and he wasted no time doing just that.

When money is created out of thin air there is suddenly more of it to allocate to the things it can buy. Prices go up not as a consequence of demand or value but only because there are more dollars to spread around. It is little surprise, then, that inflation went through the roof in the early 1970s. Subjected to pure market forces since 1971, major currencies have also more than once been the target of powerful speculation, when well-heeled traders place enormous bets aimed at artificially lowering the price of currency for their personal gain.

Most nations today are on their own when it comes to monetary and fiscal policy. And the price of gold and US dollars remain to this day free of artificial constraint, moving in response to the ebbs, flows, shocks, and follies of an ever turbulent world economy.

Harry Dexter White never lived to see his Bretton Woods creation put into action, nor of course its demise. It’s a good bet Richard Nixon’s opinion of Bretton Woods was not bolstered by his personal opinion of Harry Dexter White. From his days on HUAC onward, Nixon believed White lied to the committee. He believed White was being quite intentional and clever when he prefixed his denial of having known his accusers Chambers and Bentley with “I have no recollection of…” Nixon believed the architect of Bretton Woods was a Soviet spy.

It turns out he was right.

Harry Dexter White was indeed guilty of funneling secrets to the Soviets. He did it for quite a long time. His chief accuser was Whittaker Chambers, an editor for Time magazine and one-time Soviet agent who had renounced Communism and ratted out others, most famously senior US State Department official Alger Hiss. And White was no minor informant. According to Chambers, White’s “role as a Soviet agent was second in importance only to that of Alger Hiss—if, indeed, it was second.”

According to Chambers, Harry White began providing him Treasury documents as early as 1935. White had access to not only the most sensitive Treasury documents, but to confidential documents provided by other departments of the US government. White would also provide the occasional summary of information he thought useful and his opinions on how best to reform the Soviet monetary system.

The evidence against White was extensive. The FBI gathered more than thirteen thousand pages of it—much of it quite solid, including eight pages of notes in handwriting the FBI demonstrated was Harry White’s. Some evidence only came to light in 1995 with the release of transcripts of Soviet intelligence cables. These so-called “Venona transcripts” included revelations of internal discussions by members of the US delegation to the founding conference of the United Nations, revelations made to the Soviets by one of those members, Harry Dexter White.

It’s not clear what motivated White’s espionage. Some say he was out to secretly undermine American policy to help the Soviets, others that his actions were mostly appropriate, but that he occasionally crossed the line. It’s noteworthy too that he began passing information a decade before the US and Soviet became nuclear rivals. But it’s clear he shared confidential information he should not have, and that he knew he’d be in trouble were his actions revealed.

One of the more astonishing revelations in the Venona transcripts concerned White’s role in Japan’s decision to bomb Pearl Harbor. In late 1941 the Soviets wanted badly for the US to enter the war and, through intermediaries, enticed White to recommend to FDR that he deliver an ultimatum to Japanese Emperor Hirohito. The Soviets knew the one thing sure to tick off the Emperor was an ultimatum.

There were of course many factors leading up to Japan’s attack, but there is no dispute that White authored the ultimatum FDR delivered to Japan. The emperor decided promptly upon reading it to proceed with plans to bomb Pearl Harbor on December 7, 1941. As they did with many of their operations, the Soviets gave a nickname to this plan to draw the US into World War II. They named it Operation Snow—as in Snow White.

The Soviets did not compensate White with money—doing so would not be very Communist of them—but with gifts. Delivery of the gifts, however, did not always go according to plan. According to author Benn Steil:

“One day (likely in 1945) a carpenter in Washington received a container of caviar at his house. Then a case of vodka was delivered. Then came an engraved invitation in the mail to attend a social event at the Soviet embassy. The carpenter was dumbfounded. Finally came a telephone call from a Harry Dexter White at the U.S. Treasury. The carpenter was also named Harry White. The Treasury-White had traced his misdirected presents. He proposed that carpenter-White send him half the goods and keep the other half. “I was going to send them all back to him,” the carpenter told a reporter. “But I thought,” after reflecting on his talk with Treasury-White, that “he’s the kind of fellow, that if I send them all back, will still think that I kept half. So I did.”

In 1997 Senator Daniel Patrick Moynihan led a commission that reviewed the Venona cables. Among their conclusions was that “the complicity of Alger Hiss of the State Department seems settled. As does that of Harry Dexter White of the Treasury Department.”

The International Monetary Fund and World Bank remain powerful institutions to this day, though not without fierce critics and growing competition—the Asian Development Bank has dozens of member nations and quite a lot of money at its disposal. From time to time, there are calls for a new Bretton Woods, and perhaps one day there will be a global economic accord that includes the likes of China and India, the latter of which was still a colony of Great Britain in 1944.

If there is one day another conference like Bretton Woods, it’s a safe bet attending nations will read the final text thoroughly before agreeing, and give their representatives at the negotiating table a thorough background check.

© 2016 All Rights Reserved. Do not distribute or repurpose this work without written permission from the copyright holder(s).

Printed from https://www.damninteresting.com/foreign-exchanges/

Since you enjoyed our work enough to print it out, and read it clear to the end, would you consider donating a few dollars at https://www.damninteresting.com/donate ?

Excellent piece! Informative, surprising and well written. Looking forward to seeing more work by this new writer.

But… what happened to the hotel? I expected a closing to that as the article began with it!

Interesting article though, thanks :)

Whoa,what fun to read, Michael. Congrats on an interesting story. Can’t wait to hear the

Podcast which I’ll enjoy even more.

Greta read Michael. Thanx for sharing!

The Hotel is alive and kicking:

https://www.omnihotels.com/hotels/bretton-woods-mount-washington

Being something of a monetary moron, I learned more from this article than from 16 years of schooling. Keep up the good work!

Hsbeak

12/29/16

Great Article! I’d love to know why he was a spy for Russia when he clearly made America the big boss of the financial world. Maybe he was a double agent…

Nations could buy bancors with gold but not redeem them for gold…

How convenient. So, who got the gold? Who printed the bancors? I suspect some conniving was going on behind the scenes, in addition to getting the delegates to sign the altered document.

A fine article overall. Just a small quibble: Zimbabwe calls their currency ‘dollars’, but it’s not tied to anything. That’s why they ended up with their $100 trillion banknotes (and those were printed after they dropped 12 zeroes off the value of their ‘dollar’).

The Zimbabwean dollar was gradually discontinued starting in 2009. They no longer have a national currency, though they recently started issuing “bond notes” pegged to the US dollar. Nine foreign currencies are recognized as legal tender; the US dollar is used for government transactions.

Consider that the Bitcoin may be the new Bretton Woods that will be adopted without a multi-government conference. It is very much still developing, but its scarcity would act very much like gold does under a gold standard. Bitcoin is not ready for mass adoption and private transactions of all kinds, so potentially it could act more like Keynes’ bancor.

Piping Hot welcome. Great article: interesting and unexpected presented w a good sense of humor. Keep writing.

I add my voice to the chorus singing praises to our new-found writer. This was an excellent article; well researched and written, intriguing, leaving the reader with the ntellectual equivalent of pushing away from the table after a delightful meal. While I have not yet listened to the podcast ( 5:30 on a weekend morning is not the best time for blaring computers in this household)I do hope to be reading more of your work soon, Michael!

FAntastic ! Ilustrative, informative, interesting.

many Thanks

franco(Brasil)

Ard Ri, I’m just speculating here, but if White was a communist he likely was one who envisioned the USA and the American culture instead of the USSR as the central hegemony/world proletariat.

Magnificent article. Clarified points on which I was ignorant and wondering.

Great article! This new writer is clearly experienced and rather entertaining.

I do, however, have several questions for anyone out there who can answer it: what exactly did it mean that only US dollars could be converted into gold? Did countries have to peg their currencies to the dollar? Did they have to trade consistently with the US to have a supply of dollars to work with? In general, why was it advantageous for only the US dollar to be convertible into gold?

Also, why exactly was it bad that US gold reserves were going down in the 1970’s and why did Nixon axe the Breton Woods agreement? Did it mean the US’s international influence was declining- if so, wouldn’t Nixon’s actions hurt that influence even more?

I’m sorry if these are stupid, common-sense questions. I just am genuinely confused and the matters aren’t explicitly addressed in the article, implying that you’re just supposed to know the answers due to common sense. So, I apologize if I lack the latter.

Thanks!

Excellent article. Much enjoyed and much learned. I will be watching for another from this author.

Amazing! Thank you!

Good article. What is the name of music played in the end?

@Hal: That music was made in-house, it’s called “Surface Tension” because I originally wrote/recorded it for the 2014 episode Surface Tension. I create the music at its fullest density, but then I record individual instrument tracks individually (and with some variations) so I can layer and loop them to make a dynamic soundtrack. I call the approach “lasagna loops,” though there may be a more technical term I am unaware of.

I hope you were asking because you liked it, not because you felt it was bad. I’m relatively new to music-making, so it’s difficult for me to self-assess.

What exactly did it mean that only US dollars could be converted into gold? Did countries have to peg their currencies to the dollar? Did they have to trade consistently with the US to have a supply of dollars to work with? In general, why was it advantageous for only the US dollar to be convertible into gold?

Also, why exactly was it bad that US gold reserves were going down in the 1970’s and why did Nixon axe the Breton Woods agreement? Did it mean the US’s international influence was declining- if so, wouldn’t Nixon’s actions hurt that influence even more?

~~~~

Each US dollar had a value of $35 per ounce, and only US dollars could be used to buy gold. All currencies were pegged to the value of the US dollar (global fixed exchange rate). Other countries needed to hold US dollars in order to buy gold for their own central banks and currencies. Pegged exchange rates have their place – as said in the article it ensures the value of a nation’s currency by pegging it to something else which in turn mitigates shocks to the financial system. Advantages include no exchange rate risk or inflation risk on loans made – very handy for massive lenders! This scheme was fine in the beginning but several things occurred which broke down the system.

Firstly, Europe was rebuilding after the war. Their economies were growing at a massive pace which made their national currencies more valuable. With the fixed exchange rates prevailing the European economies should have been able to buy more goods and services from the US over time but were unable to.

Second, each developed economy participating in the Bretton Woods system had to hold a certain amount of gold proportional to their money supply. Growing economies necessitated larger gold holdings. So what we saw in this period were gold outflows from the US to Europe.

Thirdly, with increasing US borrowing due largely to the escalation of the Vietnam War and lower US gold reserves European powers began to doubt the US’s ability to maintain the dollar-gold convertibility scheme. This was most famously noted by De Gaulle in 1965 who converted the whole US dollar holdings of France into gold.

The Bretton Woods system limped along for a few more years when the exchange rates first became a little more generous, then currencies were allowed to trade in a small trading range, but given that the US was wholly unable to convert all the gold holdings of other nations if requested and currencies were starting to converge in value it was recognised that the fundamental problems were too great and Nixon finally ended unconditional convertibility in August 1971. As said in the article the failure of the global financial system contributed in no small way to the inflation epidemic of the seventies with assistance from supply side shocks in oil and other products.

I can guess that the end of Bretton Woods didn’t have any major negative effects on US influence. All major participants knew the system was unsustainable and Nixon formally acknowledged that. The US dollar was still the global reserve currency but currencies were free to float against each other.

Dear Micheal,

I hate to be a nitpick, but Newton is the father of Classical mechanics/physics. Albert Einstein is credited for laying the foundation of Modern Physics. While classical physics deals with gravity, inertia and such modern physics handles more complex theories like wave-particle duality and conversion of mass into energy when it travels at the speed of light, also represented by the famous equation e=mc^2.

Regards,

Felicia

When I saw the title of this article I was suspicious. I started to look it over and I saw the name Harry Dexter White I was alarmed expecting a writer to praise this guy oblivious to the fact that he was a soviet agent who had a major role in walking us into WW II. It was really gratifying to see such an informational and skilled explanation of an important trend in history that isn’t always recognized. Well done.